How AI Is Changing Stock Trading in 2025

Stock markets move fast, and in 2025, AI systems are making them smarter. From predictive analytics to algorithmic trading, AI is reshaping how investors trade.

TrendFlash

Introduction: The AI Revolution in Finance

Stock markets move at incredible speed. Every microsecond matters. In 2025, AI systems are making trading decisions, analyzing markets, and predicting price movements with capability humans could never match. This transformation is reshaping how people invest, trade, and think about financial markets.

This guide explains how AI is changing stock trading, what impact it's having, and what it means for individual investors and institutions.

The AI Transformation in Trading

From Manual to Algorithmic

2015: Traders watched charts, placed orders manually 2025: AI systems analyze thousands of data points simultaneously, identify patterns, and execute trades in milliseconds

This isn't incremental improvement—it's a fundamental shift in how financial markets operate.

What AI Does in Modern Trading

1. Market Analysis at Scale

AI systems analyze:

- Price history (years of data instantly)

- Volume patterns (unusual activity detection)

- News sentiment (automated analysis of thousands of news items)

- Social media signals (what investors are saying)

- Correlations (which assets move together)

- Macroeconomic indicators (interest rates, GDP, employment)

A human trader analyzing one chart. An AI system analyzing 10,000 simultaneously.

2. Predictive Analytics

Machine learning models predict price movements:

- Short-term predictions (next hour/day)

- Medium-term predictions (next week/month)

- Long-term trends (fundamental value)

- Volatility forecasting

- Crash detection

Accuracy: Modern ML models achieve 55-65% accuracy on price direction (better than 50% random, compounds to significant returns)

3. Risk Management

AI systems identify risk automatically:

- Portfolio concentration

- Correlated positions

- Liquidity risks

- Black swan events

- Hedging recommendations

4. Automated Execution

AI doesn't just recommend trades—it executes them:

- Optimal execution algorithms (minimize slippage)

- High-frequency trading (thousands of trades/second)

- Portfolio rebalancing (automatic)

- Tax-loss harvesting (automated)

- Stop-loss orders (intelligent triggers)

5. Sentiment Analysis

AI reads and analyzes human sentiment:

- News sentiment (positive/negative/neutral)

- CEO commentary tone

- Social media sentiment

- Earnings call language

- Market psychology indicators

Real-World Impact: How Trading Has Changed

Speed

Trades that took humans minutes now happen in microseconds. This benefits:

- Systematic traders (using algorithms)

- Institutions with technology budgets

- Quant hedge funds

- Retail traders with robo-advisors

Democratization

AI-powered tools that were exclusive to Wall Street are now available to retail investors:

- Robo-advisors (Betterment, Wealthfront)

- Algorithmic trading platforms

- AI stock picking services

- Automated portfolio management

Market Efficiency

AI makes markets more efficient by:

- Eliminating obvious arbitrage opportunities

- Incorporating information faster

- Reducing pricing inefficiencies

- Making human edge harder to find

Volatility

AI trading can increase short-term volatility:

- Flash crashes (rapid sell-offs followed by recovery)

- Herd behavior (similar AI trading decisions)

- Cascade effects (algorithms triggering other algorithms)

- Liquidity challenges in crises

AI Trading Strategies in 2025

Mean Reversion

Stocks that deviate from average tend to revert. AI identifies these opportunities.

- Performance: 8-12% annual returns historically

- Risk: Can fail during structural market changes

Momentum Trading

Stocks that have been going up tend to continue going up (short-term). AI rides these waves.

- Performance: 12-15% annual returns

- Risk: Whipsaw losses when trend reverses

Sentiment-Based Trading

AI analyzes news/social sentiment and trades accordingly.

- Performance: 10-14% annual returns

- Risk: Sentiment can be misleading/temporary

Arbitrage

AI finds price discrepancies across markets/securities and profits from them.

- Performance: Lower but consistent

- Risk: Very low (nearly risk-free)

Impact on Individual Investors

Good News

- AI-powered robo-advisors are cheaper than human advisors

- Automated rebalancing happens without you doing anything

- Tax optimization is automatic

- Better risk management

- More investment options available

Bad News

- Harder for individuals to beat the market

- Requires larger capital to compete

- Flash crashes can cause unexpected losses

- Less transparency in algorithm decision-making

- Systemic risks if algorithms fail simultaneously

The Regulatory Response

Regulators are watching AI trading closely:

- Algorithmic trading limits during volatile times

- Circuit breakers halting trading if moves too extreme

- Higher capital requirements for AI traders

- Transparency requirements for algorithms

- Stress testing of trading systems

What This Means for Your Investment Strategy

If You're a Buy-and-Hold Investor

Good news: You're not competing with algorithms. Investing in index funds remains solid strategy despite AI trading.

If You're an Active Trader

You're competing against AI. Consider:

- Using AI tools yourself (robo-advisors)

- Longer time horizons (AI dominates short-term)

- Focusing on fundamental analysis (finding overlooked value)

- Options strategies (complex enough to not be fully automated)

If You're Building Capital

Use AI-powered tools:

- Robo-advisors (cheaper than human advisors)

- Automated rebalancing

- Tax-loss harvesting automation

- Dollar-cost averaging (removes emotion)

Looking Ahead: AI in Finance

Expect:

- More sophisticated AI models

- Broader use of ML across financial services

- Integration of AI with cryptocurrency/blockchain

- Personalized investment strategies at scale

- Stronger regulation and oversight

Conclusion: AI as Financial Partner

AI in trading isn't science fiction—it's present reality reshaping financial markets. Whether you embrace it through robo-advisors, compete with your own algorithms, or accept that active trading is harder, understanding AI's role in finance is essential for modern investors.

The future of investing isn't human vs. machine—it's informed humans leveraging machine intelligence. Explore more on AI in finance and stay updated at TrendFlash.

Share this post

Categories

Recent Posts

Opening the Black Box: AI's New Mandate in Science

AI as Lead Scientist: The Hunt for Breakthroughs in 2026

Measuring the AI Economy: Dashboards Replace Guesswork in 2026

Your New Teammate: How Agentic AI is Redefining Every Job in 2026

Related Posts

Continue reading more about AI and machine learning

AI in Finance: How Agents & Generative Tools Are Transforming Risk, Trading & Compliance

The financial sector is being reshaped by autonomous AI agents and generative tools. Discover how these technologies are creating a competitive edge through sophisticated risk modeling, automated compliance, and adaptive trading strategies.

AI in Finance 2025: From Risk Models to Autonomous Trading

Discover how artificial intelligence is transforming financial services in 2025, moving beyond traditional models to power autonomous systems that optimize trading, enhance security, and navigate complex regulatory demands.

AI-Powered Personal Finance: How Algorithms are Managing Money in 2025

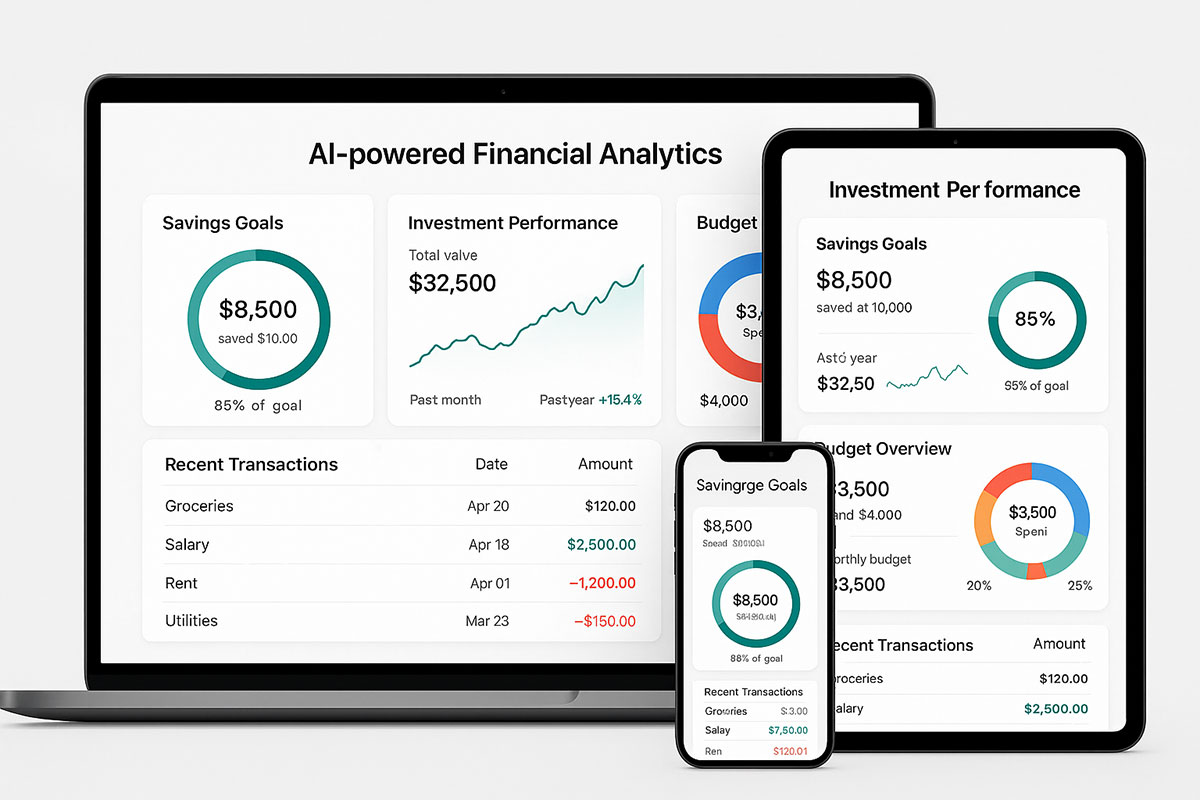

AI financial assistants now manage billions in personal assets. These smart systems optimize spending, automate investing, and prevent financial mistakes in real-time.