AI in Finance: How Agents & Generative Tools Are Transforming Risk, Trading & Compliance

The financial sector is being reshaped by autonomous AI agents and generative tools. Discover how these technologies are creating a competitive edge through sophisticated risk modeling, automated compliance, and adaptive trading strategies.

TrendFlash

Introduction: The New Architects of Finance

The financial world is undergoing its most significant transformation since the advent of digital trading. In 2025, artificial intelligence has evolved beyond a simple analytical tool into an active, strategic participant. Financial institutions are no longer just using AI to parse data; they are deploying AI agents that can autonomously execute multi-step workflows and leveraging generative tools for deep scenario analysis and research. This shift is accelerating as firms seek a competitive edge, operational efficiency, and robust responses to regulatory complexity. With global AI investment soaring and performance on demanding benchmarks sharply increasing, the technology has reached a maturity level that makes these advanced applications not just possible, but profitable.

Beyond Chatbots: The Power of Agentic AI in Finance

Agentic AI represents a fundamental leap from tools that answer questions to systems that get things done. These agents are built to act autonomously, chain tasks together, and make decisions based on goals. In finance, this translates into virtual employees capable of managing complex, cross-platform operations.

What makes financial AI agents unique?

- Advanced Reasoning and Planning: They can break down a high-level goal like "hedge portfolio risk" into a logical sequence of sub-tasks: analyzing market exposure, simulating different hedging strategies, and executing trades across multiple venues.

- Multi-Tool Use: They can connect to and operate a suite of financial tools—bloomberg terminals, risk management systems, execution platforms, and internal databases—without human intervention.

- Memory and Context: They maintain a memory of past actions and market conditions, allowing them to learn from outcomes and refine strategies over time.

Key Applications Transforming the Financial Sector

The integration of AI agents and generative tools is creating new paradigms across core financial functions.

1. Autonomous Trading and Portfolio Management

AI agents are moving beyond pre-programmed algorithmic trading to adaptive, goal-oriented portfolio management. Instead of simply executing a set strategy, these agents can continuously monitor global news, economic indicators, and real-time market data to adjust portfolios dynamically. They can balance objectives like maximizing returns and minimizing risk based on evolving market conditions, making decisions in milliseconds based on a vast array of unstructured and structured data that would be impossible for a human team to synthesize in real-time.

2. Dynamic and Real-Time Risk Modeling

Traditional risk models often rely on historical data and can be slow to update. Generative AI tools are now being used to create and simulate thousands of potential market scenarios, including rare "black swan" events, to stress-test portfolios in ways never before possible. AI agents can then monitor for the early warning signs of these scenarios playing out in real life, allowing for proactive risk mitigation. This shift from static, historical analysis to dynamic, forward-looking risk assessment is a game-changer for institutional stability.

3. Intelligent Compliance and Regulatory Reporting (RegTech)

The burden of compliance is immense and growing. AI agents are being deployed to automate the entire compliance workflow. This includes real-time transaction monitoring for suspicious activities, automatically generating and filing regulatory reports, and continuously scanning for updates to regulatory frameworks across different jurisdictions. Furthermore, generative tools with Retrieval-Augmented Generation (RAG) can ground their responses in verified legal and regulatory documents, providing compliance officers with accurate, cited answers to complex queries and drastically reducing research time. This application alone can save institutions millions in manual labor and potential fines.

4. Generative Tools for Research and Client Services

Generative AI is supercharging financial research and client interactions. Analysts use these tools to instantly summarize lengthy earnings reports, generate draft research notes, and perform sentiment analysis on market news. In client services, generative powers hyper-personalized investment proposals and can instantly generate reports on portfolio performance, tailored to the client's level of financial literacy. This not only boosts productivity but also enhances the quality and speed of service.

The 2025 Financial AI Vendor Stack

Building these capabilities requires a sophisticated stack of technologies. Financial institutions are blending proprietary development with best-in-class vendor solutions.

| Tool Type | Role in the Stack | Examples & Technologies |

|---|---|---|

| Foundation Models | Provide the core reasoning and language capabilities for agents and generative tasks. | GPT-4o, Claude 3.5 Sonnet, Gemini 2.5 Pro, and fine-tuned open-source models like Llama 3 for sensitive data. |

| Agentic Frameworks | Provide the scaffolding for building, controlling, and deploying AI agents. | LangChain, LlamaIndex, Microsoft's AutoGen, and custom in-house platforms. |

| RAG & Knowledge Bases | Ground AI responses in verified, internal data to ensure accuracy and reduce hallucinations. | Vector databases (Pinecone, Weaviate) integrated with internal compliance manuals, trade repositories, and research libraries. |

| Execution & Data Platforms | The infrastructure agents act upon and draw data from. | Bloomberg Terminal, Refinitiv, execution management systems (EMS), and cloud data platforms (Snowflake, Databricks). |

Navigating the Regulatory and Ethical Landscape

As with any disruptive technology in finance, adoption comes with significant regulatory considerations. The rise of AI incidents has prompted global governments to step up, with U.S. federal agencies introducing 59 AI-related regulations in 2024—more than double the number in 2023. Key focus areas for regulators in 2025 include:

- Explainability and Auditability: Regulators demand to understand why an AI agent made a specific trade or decision. The "black box" problem remains a significant hurdle.

- Model Robustness and Fairness: Ensuring AI models are not biased and are resilient to manipulation or adversarial attacks.

- Data Privacy and Residency: Strict adherence to regulations like GDPR is paramount, especially when using cloud-based AI services.

- Accountability: Ultimately, financial firms remain accountable for the actions of their AI systems. Clear human oversight protocols are not optional.

The Future of AI in Finance

The trajectory is clear: AI will become increasingly agentic, autonomous, and embedded into the core of financial operations. We are moving towards a future where human traders, analysts, and compliance officers work in seamless synergy with AI agents, forming hybrid teams that leverage the strategic intuition of humans with the data-processing speed and scale of machines. As the 2025 Stanford AI Index Report notes, the responsible AI ecosystem is evolving, and in the high-stakes world of finance, building trust through transparency, rigorous testing, and robust governance will be the key to sustainable innovation.

Related Reading

Tags

Share this post

Categories

Recent Posts

Opening the Black Box: AI's New Mandate in Science

AI as Lead Scientist: The Hunt for Breakthroughs in 2026

Measuring the AI Economy: Dashboards Replace Guesswork in 2026

Your New Teammate: How Agentic AI is Redefining Every Job in 2026

Related Posts

Continue reading more about AI and machine learning

AI in Finance 2025: From Risk Models to Autonomous Trading

Discover how artificial intelligence is transforming financial services in 2025, moving beyond traditional models to power autonomous systems that optimize trading, enhance security, and navigate complex regulatory demands.

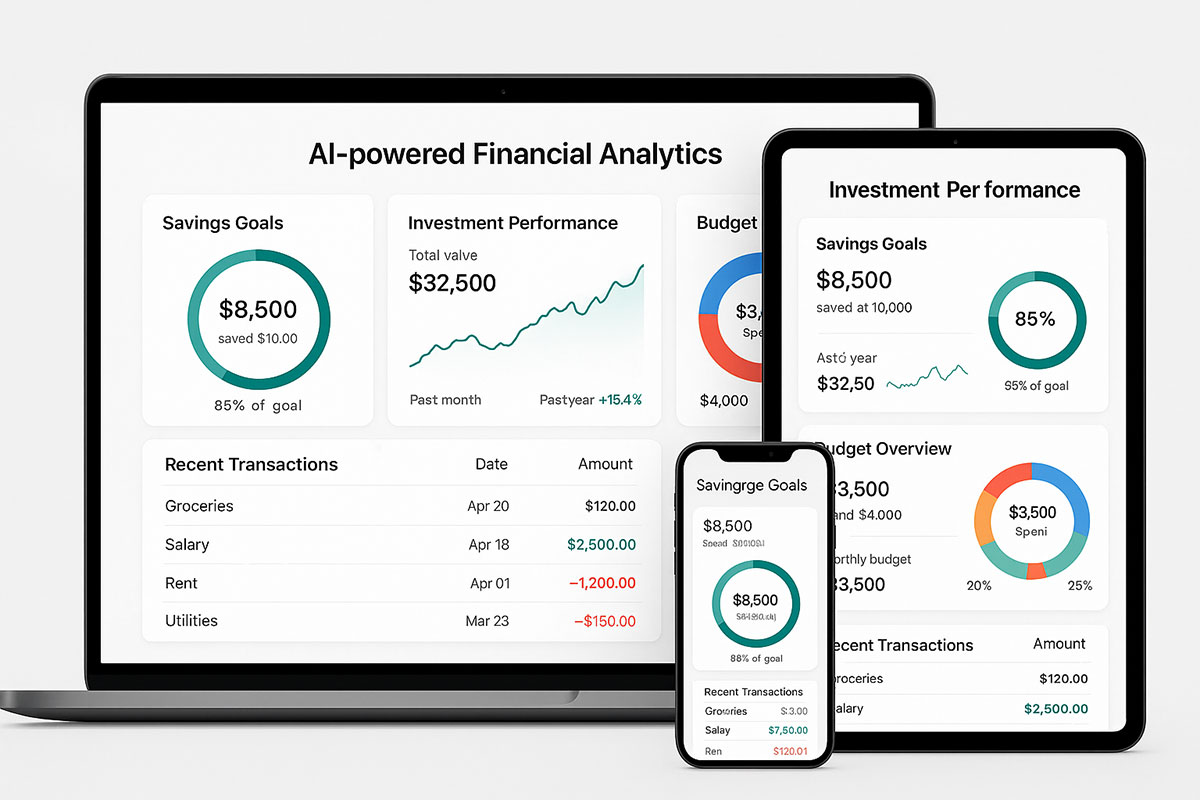

AI-Powered Personal Finance: How Algorithms are Managing Money in 2025

AI financial assistants now manage billions in personal assets. These smart systems optimize spending, automate investing, and prevent financial mistakes in real-time.

AI-Powered Stock Trading in 2025: Can Algorithms Really Beat the Market?

Algorithmic trading dominated 68% of all US stock market transactions in 2024. By 2025, AI-powered systems are making million-dollar decisions in milliseconds. But can these algorithms truly deliver consistent alpha?