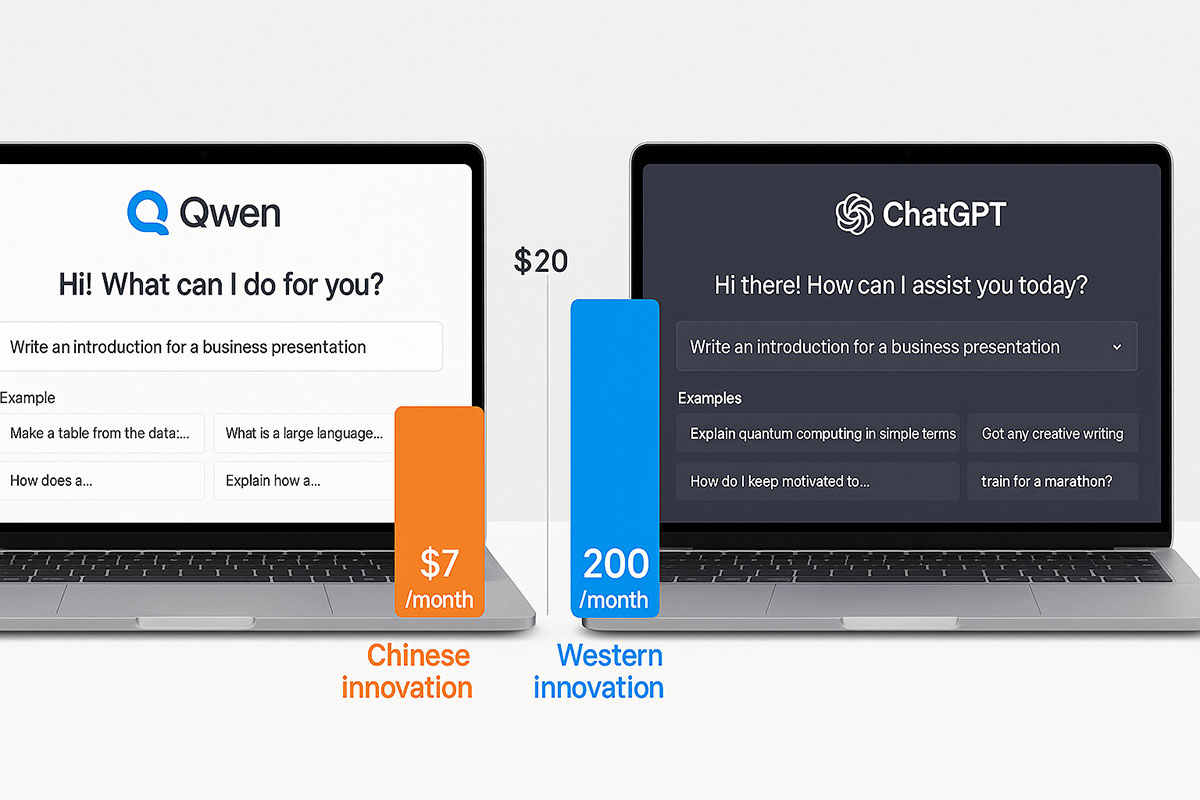

Alibaba Qwen Chatbot: The Chinese AI Cheaper Than ChatGPT (November 2025)

Alibaba just slashed Qwen chatbot prices by nearly 50%, making it the most cost-effective enterprise AI available. Discover why this Chinese AI model outperforms ChatGPT at a fraction of the cost, and what it means for the global AI landscape in 2025.

TrendFlash

The AI Price War Just Got Brutal: Alibaba Strikes Back

The artificial intelligence landscape has reached an inflection point. On November 17, 2025, Alibaba made a strategic move that reverberated through the tech industry—the company launched a dramatically upgraded Qwen chatbot with pricing that undercuts ChatGPT by approximately 50 percent. This isn't just another product release. It's a calculated response to the price war initiated by DeepSeek, and it signals a fundamental shift in how Chinese AI companies are competing not just domestically, but globally.

For small businesses, startups, and enterprises operating on tight margins, this development changes everything. While most of the world's attention has been focused on OpenAI's incremental improvements and Claude's creative capabilities, Alibaba has been quietly building something different—a multimodal AI powerhouse that matches or exceeds its Western counterparts while costing a fraction of the price.

What Is Qwen? Understanding Alibaba's AI Ambition

Alibaba's Qwen (pronounced "chen") represents the company's flagship large language model series, representing years of investment and engineering expertise. The name itself reflects a vision—Qwen stands for the company's aspiration to democratize AI through powerful, accessible models. Unlike some competitors that focus on incremental improvements, Qwen was built from the ground up to excel in multilingual environments, handle complex reasoning tasks, and process multiple data types simultaneously.

The latest iteration, Qwen3-Max, represents a significant advancement over previous versions. This trillion-parameter Mixture-of-Experts (MoE) model has been trained on over 20 trillion tokens of data, giving it an extraordinarily broad knowledge base and the ability to understand nuanced context that earlier models often miss.

What makes Qwen fundamentally different from traditional large language models? It's the architecture. Rather than activating all neural network parameters for every task, Qwen3-Max uses a Mixture-of-Experts approach, where only a subset of the model's capabilities activate for specific tasks. This means faster processing, lower computational requirements, and dramatically reduced costs—without sacrificing performance.

Breaking Down the Pricing Revolution

This is where the November 2025 update becomes genuinely transformative. Let's examine the numbers that are sending shockwaves through enterprise procurement departments worldwide.

API Pricing Comparison (Per Million Tokens):

| Model | Input Token Cost | Output Token Cost | Cost Ratio to ChatGPT |

|---|---|---|---|

| ChatGPT-4o | $5.00 | $15.00 | 1x (Baseline) |

| Claude 3.5 Sonnet | $3.00 | $15.00 | 0.6x |

| Qwen2.5-Max | $0.38 | $1.20 | 0.076x |

| Qwen3-Max (November 2025) | $0.459 (Input ≤32K tokens) | $1.836 (Input ≤32K tokens) | 0.092x |

The most striking revelation is this: Qwen3-Max costs approximately 10 times less than GPT-4o for comparable tasks. For a mid-sized company processing 100 million tokens monthly, switching from ChatGPT-4o to Qwen could save over $450,000 annually—money that could be reinvested in product development, customer acquisition, or team expansion.

But here's the catch that most commentators miss: Alibaba didn't achieve this price point through predatory pricing or subsidies that might evaporate tomorrow. The company achieved it through architectural innovation. The MoE approach doesn't just reduce costs; it increases efficiency. For organizations operating at scale, this means more capability per dollar spent.

Off-peak batch processing offers an additional 50 percent discount, bringing the effective cost of Qwen3-Max down to roughly $0.23 per million input tokens for non-time-critical operations. For data processing applications, document analysis, and training workflows, this becomes economically irresistible.

Multimodal Capabilities: Processing the World in Multiple Formats

Pricing is important, but capability ultimately determines adoption. Here's where Qwen demonstrates genuine technological sophistication.

Qwen systems can process and generate content across text, images, audio, and video—a multimodal capability that positions it alongside GPT-4o and Claude 3.5 Sonnet. However, Qwen's implementation has specific advantages in certain domains.

The model can process video inputs up to 20 minutes in length, enabling sophisticated video analysis that most competitors require segmentation for. Audio processing supports 29 languages, including Mandarin, Arabic, Hindi, and less commonly supported languages, addressing a genuine gap in Western models that often underperform on non-English content.

A particularly impressive capability is Qwen's ability to generate SVG code directly from images—translating visual designs into web-ready code. For product designers, marketers, and developers working with visual assets, this eliminates entire workflow steps that typically require manual intervention or additional tool integration.

The image-to-text capabilities have demonstrated exceptional performance in mathematical reasoning tasks. When processing images containing equations, diagrams, or technical illustrations, Qwen consistently outperforms alternatives in extracting accurate information and providing detailed explanations.

Performance Benchmarks: Where Qwen Actually Wins

Performance claims mean little without rigorous benchmarks. The November 2025 evaluations reveal a compelling picture.

On Arena-Hard—a benchmark that approximates human preferences for AI responses—Qwen2.5-Max outperforms DeepSeek V3. On LiveCodeBench, which tests genuine programming capability with real-world coding challenges, Qwen achieves a 92.7 percent success rate, exceeding GPT-4o's 90.1 percent and Claude's 88.9 percent.

For mathematical reasoning tasks, particularly those involving complex symbolic manipulation or multi-step logic, Qwen demonstrates superior performance compared to models costing 5-10 times more. This advantage stems from the model's training methodology, which emphasized reasoning chains and explainability over mere answer correctness.

The model handles longer context windows than many competitors—128,000 tokens is standard for Qwen models, enabling analysis of lengthy documents, extended conversations, and comprehensive project codebases without the fragmentation that affects shorter-context models.

New Features in the Revamped November 2025 Qwen App

Alibaba didn't just update pricing. The company fundamentally reimagined the consumer interface, transitioning from the previous Tongyi app to a more powerful Qwen application available on iOS, Android, and web platforms.

Autonomous Report Generation: The upgraded app can generate comprehensive research reports with a single command, automatically producing multi-slide PowerPoint presentations in seconds. For business intelligence professionals, researchers, and analysts, this transforms workflow timelines. What previously required several hours of work—research, synthesis, formatting, and presentation design—now takes minutes.

Agentic AI Integration: Alibaba is rolling out agent-style features designed specifically for e-commerce applications. These agents can autonomously handle shopping interactions, product recommendations, and transaction processing on platforms like Taobao. This represents a strategic move beyond simple chatbot capabilities toward true autonomous commerce assistance.

Real-Time Personalization: The interface learns user preferences over extended interactions, tailoring responses, suggestions, and output formats based on demonstrated preferences. Unlike stateless interfaces where each conversation begins fresh, Qwen builds understanding of individual user contexts.

Enterprise Integration: API access remains straightforward, with comprehensive documentation enabling integration into existing enterprise systems. Batch processing APIs allow organizations to process large volumes of requests asynchronously, perfect for background processing tasks that don't require real-time responses.

Use Cases Where Qwen Genuinely Excels

Cost advantage alone doesn't drive adoption. Specific use cases reveal where Qwen demonstrates particular competitive advantages.

Content Generation at Scale: Media companies processing multilingual content find Qwen's superior non-English performance and lower costs compelling. An Indian news organization could generate content in Hindi, Tamil, Bengali, and English simultaneously at a fraction of previous costs.

Financial Analysis: Banks and fintech companies conducting pattern analysis across transaction datasets benefit from Qwen's mathematical reasoning capabilities. The model excels at identifying anomalies, predicting market trends, and generating risk assessments.

Software Development: Developers using Qwen for code generation report surprisingly competitive results. The model's training on global code repositories means it understands architectural patterns, handles different programming languages effectively, and generates production-ready code.

Research and Academia: Researchers analyzing papers, synthesizing findings across multiple sources, and generating literature reviews find Qwen's extended context window and reasoning capabilities particularly valuable.

Customer Service Automation: Companies serving diverse geographic markets appreciate Qwen's multilingual competence and lower operational costs. Processing customer inquiries in 29 supported languages simultaneously becomes economically viable.

The Geopolitical Reality: Why Chinese AI Is Suddenly Competitive

Understanding Qwen's competitive position requires acknowledging broader geopolitical and economic factors reshaping the AI landscape.

Western AI companies, particularly OpenAI and Anthropic, have prioritized safety research, regulatory compliance, and high-margin enterprise deployments. This approach has generated extraordinary valuations and attracted top talent. However, it has also resulted in relatively constrained pricing strategies designed to maintain premium positioning.

Chinese AI companies, conversely, have adopted an explicit strategy of maximizing market penetration through aggressive pricing and open-source releases. Alibaba, Baidu, and others view market share as more strategically valuable than near-term profitability in this nascent phase of AI commercialization.

Additionally, the Chinese market's scale and competitive intensity create natural testing grounds for rapid iteration. DeepSeek's emergence as a serious competitor, launching models with exceptional efficiency at rock-bottom prices, forced competitors like Alibaba to accelerate their own pricing strategies. This internal competitive pressure has paradoxically accelerated innovation.

Furthermore, Chinese investment in AI infrastructure has been extraordinary. While compute costs have declined globally, China's domestic infrastructure investments have created cost advantages that Chinese companies can pass on to users. What appears as "subsidized" pricing is often the natural result of lower underlying operational costs.

How to Access and Use Qwen: A Practical Guide

For Consumers: Download the Qwen app from Apple App Store or Google Play Store in China, with an international version rolling out progressively to other regions. The consumer interface operates largely free, with optional premium features and usage tiers.

For Developers: Access Qwen through Alibaba Cloud's API platform at alibabacloud.com. Create a developer account, select the desired Qwen model version, and generate API keys. Documentation is comprehensive, with SDKs available for Python, JavaScript, Java, and Go.

For Enterprise: Contact Alibaba Cloud's enterprise sales team for custom deployment options, including on-premise deployments for organizations with strict data residency requirements. Volume discounts apply for organizations processing over 1 billion tokens monthly.

Popular Integration Points:

- Browser extensions for web-based research and content generation

- IDE plugins for developers using VS Code, JetBrains IDEs, and other development environments

- Workflow automation through Zapier, Make.com, and other integration platforms

- Native Slack bots for team communication and collaborative work

The Investment Angle: Valuation Wars and What They Mean

Alibaba's aggressive Qwen pricing strategy sends clear signals about the company's strategic objectives. The e-commerce giant isn't competing for the premium enterprise segment dominated by OpenAI. Instead, Alibaba is pursuing market volume and ecosystem lock-in.

This matters for investment considerations. Companies heavily invested in OpenAI's infrastructure through Microsoft partnership agreements face pressure to reconsider build-versus-buy decisions. Enterprise customers spending substantial budgets on API consumption suddenly see alternatives that deliver comparable functionality at 90 percent lower cost.

For investors, this pricing pressure will likely accelerate across the AI API market. The era of 10-100x markups for AI capabilities is concluding. Companies that built business models assuming premium AI pricing may discover their economics have fundamentally shifted.

However, this also creates opportunities. Organizations that successfully navigate the transition—migrating non-critical workloads to cost-effective alternatives while maintaining premium models for mission-critical applications—will see dramatic operational cost reductions that flow directly to the bottom line.

Challenges and Limitations: Understanding the Trade-offs

Despite its advantages, Qwen presents certain limitations worth acknowledging.

Data Sovereignty Questions: Many organizations remain hesitant about processing sensitive data through Chinese infrastructure, particularly those in regulated industries or with government clients. While Alibaba offers enterprise deployments, regulatory uncertainty persists in some jurisdictions.

Less Established Safety Track Record: OpenAI has published extensive research on model safety, alignment, and mitigation of harmful outputs. While Qwen demonstrates responsible AI practices, its track record is shorter and less comprehensively documented in academic literature.

Limited Real-Time Integration: Unlike some Western models with integrated real-time web access and current information feeds, Qwen relies primarily on training data knowledge cutoffs, though this is being incrementally improved.

Smaller Ecosystem: The developer ecosystem around Qwen, while growing, remains smaller than the vibrant communities around GPT-4 and Claude. Fewer third-party tools, fewer community-built extensions, and fewer deployment examples exist.

The Future of AI Economics: What November 2025 Signals

Alibaba's Qwen pricing strategy and technology capabilities signal fundamental shifts in the AI landscape heading into 2026 and beyond.

The days of AI as a premium, access-limited commodity are ending. The business model of charging enterprise customers extraordinary margins for AI capabilities is unsustainable in the face of Chinese competition offering comparable quality at 90 percent lower cost.

Expect accelerating price competition. OpenAI, Google, and Anthropic will likely respond with their own pricing adjustments. This competition ultimately benefits consumers and enterprises—the real winners are organizations that can navigate the landscape, deploying the most cost-effective tool for each specific use case.

For developing economies, particularly in Asia where Chinese models have strategic distribution advantages, Qwen's emergence could catalyze AI adoption at a pace previously constrained by cost barriers. Imagine AI-powered customer service, content generation, and software development becoming economically viable for small businesses across India, Southeast Asia, and beyond.

Conclusion: The Qwen Moment

Alibaba's November 2025 Qwen launch represents more than a product update. It signals that the global AI market is entering its commoditization phase—and Chinese companies are leading the charge. For enterprises seeking immediate, dramatic cost reductions in AI spending without significant quality compromise, Qwen demands evaluation.

The question is no longer whether Chinese AI models can compete with Western alternatives. November 2025 proved they can—cheaper, faster, and across multiple modalities. The question is now whether Western companies can adapt their business models to a world where AI capabilities are abundant and inexpensive.

For anyone building AI-powered products, analyzing costs across workloads, and planning 2026 infrastructure investments, Qwen should be part of the evaluation matrix. The price-to-performance tradeoff has fundamentally shifted.

Related Articles

For deeper exploration of related AI developments and trends:

- Google Gemini 3 Just Launched: Its a Serious Problem for ChatGPT

- Baidu Ernie Model Beats GPT-4 Gemini: The Chinese AI Breakthrough Nobody is Covering

- AI Reasoning Models Explained: OpenAI o1 vs DeepSeek V3—The Next Leap Beyond Standard LLMs

- Multimodal AI Explained: How Text, Image, Video, Audio Models Are Merging to Create the Next Breakthrough

Category: AI News & Trends

Tags

Share this post

Categories

Recent Posts

Opening the Black Box: AI's New Mandate in Science

AI as Lead Scientist: The Hunt for Breakthroughs in 2026

Measuring the AI Economy: Dashboards Replace Guesswork in 2026

Your New Teammate: How Agentic AI is Redefining Every Job in 2026

Related Posts

Continue reading more about AI and machine learning

AI as Lead Scientist: The Hunt for Breakthroughs in 2026

From designing new painkillers to predicting extreme weather, AI is no longer just a lab tool—it's becoming a lead researcher. We explore the projects most likely to deliver a major discovery this year.

Your New Teammate: How Agentic AI is Redefining Every Job in 2026

Imagine an AI that doesn't just answer questions but executes a 12-step project independently. Agentic AI is moving from dashboard insights to autonomous action—here’s how it will change your workflow and why every employee will soon have a dedicated AI teammate.

The "DeepSeek Moment" & The New Open-Source Reality

A seismic shift is underway. A Chinese AI lab's breakthrough in efficiency is quietly powering the next generation of apps. We explore the "DeepSeek Moment" and why the era of expensive, closed AI might be over.