AI in Personal Finance 2025: Smarter Budgeting, Investing, and Saving

AI personal finance tools in 2025 are helping people in the US and worldwide budget smarter, invest better, and save more with confidence.

TrendFlash

Introduction: Personalization at Massive Scale

Every student learns differently. For decades, we've pretended they learn the same. AI makes true personalized learning possible at scale—every student gets customized curriculum, pace, and teaching style.

This guide explores how AI is transforming education.

The AI Education Revolution

Personalized Learning

Traditional: Teacher teaches 30 students at same pace, same curriculum

AI-Enabled: Each student gets personalized curriculum adapted to their pace and learning style

- Student struggles with algebra? More practice, different explanations

- Student gets it quickly? Move to harder problems

- Dyslexic student? Different presentation format

- Visual learner? More diagrams, videos

Current Tools

- Khan Academy: AI tutoring adapted to individual student

- Duolingo: Language learning personalized to each user

- Squirrel AI: Math curriculum adapted real-time

- Coursera: Personalized learning paths

- Carnegie Learning: AI algebra tutor (proven effective)

Real Results

- Students using personalized AI: 20-30% faster learning

- Khan Academy studies: 2x faster progress in math

- Carnegie Learning: 40% better retention

- Retention rate: 80%+ (vs. 50% traditional)

How AI Personalization Works

Step 1: Assess Current Level

AI quickly assesses where student is (no long testing)

Step 2: Identify Learning Style

AI determines learning preference (visual, auditory, kinesthetic, etc.)

Step 3: Customize Curriculum

AI selects problems, explanations, examples suited to student

Step 4: Adapt in Real-Time

As student learns, AI adjusts difficulty, pace, teaching method

Step 5: Predict and Intervene

AI predicts misconceptions before they solidify, intervenes proactively

Impact on Different Subjects

STEM (Math, Science, Programming)

Where AI helps most: Practice, problem-solving, visualization

Examples: Personalized math problems, chemistry simulations, coding tutorials

Impact: 20-40% faster learning

Languages

Where AI helps most: Pronunciation, conversation practice, accent reduction

Examples: Duolingo conversations, pronunciation feedback

Impact: 30-50% faster fluency

Humanities (History, Literature, Writing)

Where AI helps most: Research, brainstorming, editing

Examples: Essay feedback, research paper organization, historical simulations

Impact: Faster writing, better clarity

Soft Skills (Communication, Leadership)

Where AI helps most: Practice, feedback, simulation

Examples: Presentation feedback, negotiation simulation

Impact: Faster skill development

The Challenges

Challenge 1: Teacher Displacement Concerns

Fear: AI will replace teachers

Reality: Teachers become facilitators, coaches, mentors (more valuable role)

Solution: Reframe teacher role, invest in teacher training

Challenge 2: Access & Equity

Problem: AI tools require technology access (not all students have)

Gap: Wealthier students get personalized AI, poorer students don't

Solution: Public funding for AI tools, ensuring universal access

Challenge 3: Screen Time Concerns

Problem: More learning = more screen time

Solution: Blended learning (AI + in-person), offline activities, balance

Challenge 4: Data Privacy

Problem: Personalization requires data on student learning

Concern: Who controls this data? How is it used?

Solution: Strong privacy laws, student/parent control, transparency

The Role of Teachers in AI-Enabled Education

What Teachers Still Do (and Always Will)

- Motivation (inspire love of learning)

- Relationships (students need human connection)

- Complex judgment (understanding student struggles)

- Mentorship (life guidance beyond academics)

- Social-emotional learning (teamwork, empathy)

What Teachers No Longer Do

- Lecture to all students identically (AI does this)

- Grade routine assignments (AI does this)

- Create personalized problem sets (AI does this)

- Provide automated feedback (AI does this)

Teacher Role Transformation

Old: Lecturer, grader, keeper of knowledge

New: Coach, mentor, social-emotional guide, learning facilitator

Future of Education (2027-2030)

Prediction 1: Personalized Becomes Ubiquitous

By 2027, most schools in developed countries will use AI personalization

Prediction 2: Teacher Shortage Solved

Fewer teachers needed, but higher quality role (coaching, not lecturing)

Prediction 3: Outcome Improvement

Students learn faster, retain better, enjoy learning more

Prediction 4: Equity Concerns Emerge

Unless properly funded, AI education could worsen inequality

Conclusion: Personalized Learning at Scale Is Here

AI enables what was always the ideal: every student learning at their pace with methods suited to them. Implementation challenges remain, but the technology works. The question is whether we scale it equitably.

Explore more on AI in education at TrendFlash.

Share this post

Categories

Recent Posts

Opening the Black Box: AI's New Mandate in Science

AI as Lead Scientist: The Hunt for Breakthroughs in 2026

Measuring the AI Economy: Dashboards Replace Guesswork in 2026

Your New Teammate: How Agentic AI is Redefining Every Job in 2026

Related Posts

Continue reading more about AI and machine learning

AI in Finance: How Agents & Generative Tools Are Transforming Risk, Trading & Compliance

The financial sector is being reshaped by autonomous AI agents and generative tools. Discover how these technologies are creating a competitive edge through sophisticated risk modeling, automated compliance, and adaptive trading strategies.

AI in Finance 2025: From Risk Models to Autonomous Trading

Discover how artificial intelligence is transforming financial services in 2025, moving beyond traditional models to power autonomous systems that optimize trading, enhance security, and navigate complex regulatory demands.

AI-Powered Personal Finance: How Algorithms are Managing Money in 2025

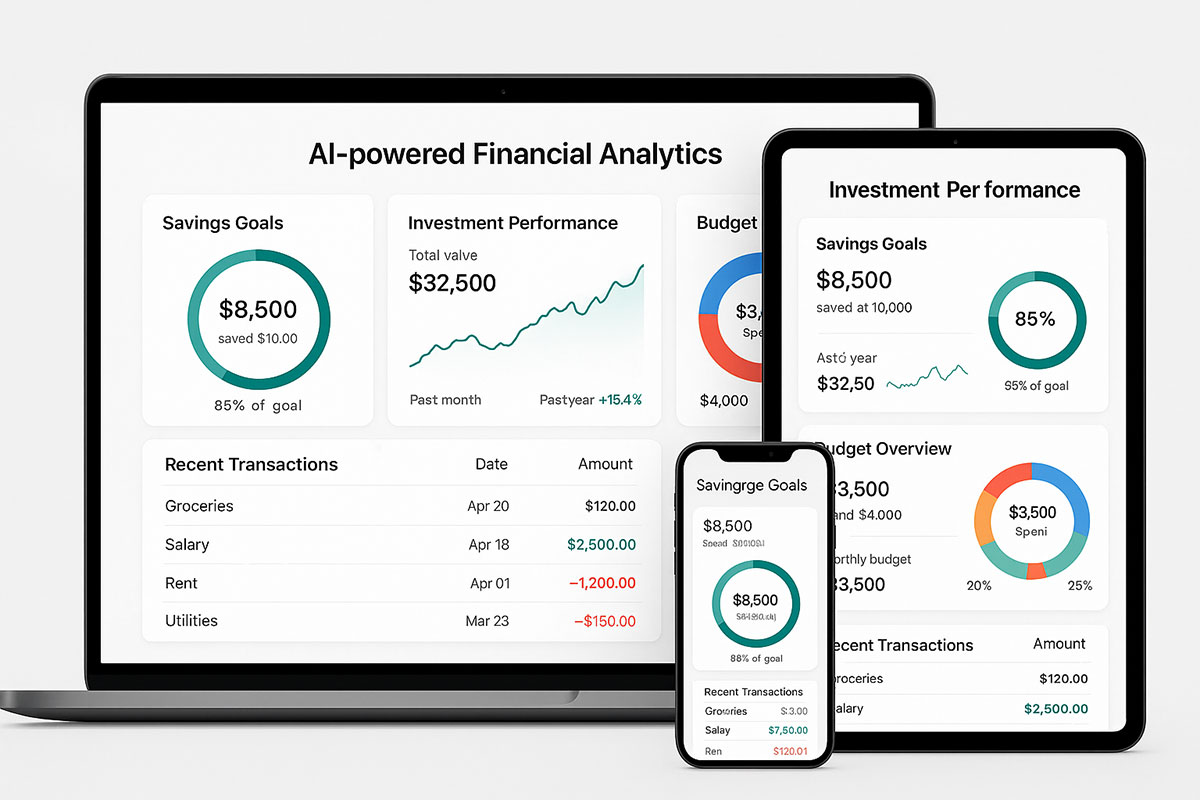

AI financial assistants now manage billions in personal assets. These smart systems optimize spending, automate investing, and prevent financial mistakes in real-time.