AI in Insurance 2025: How Algorithms Are Transforming Claims and Risk in the US

AI is reshaping the US insurance industry in 2025 — from automated claims processing and fraud detection to personalized policies and smarter risk management.

TrendFlash

Introduction: Entertainment Is Becoming AI

From movies to music to games, AI is transforming entertainment at every level. Studios are using AI to generate content, games are becoming more intelligent, music is being created by algorithms. The future of entertainment is AI-powered.

AI in Film & Television

What's Happening Now

- VFX Acceleration: AI speeds up visual effects (from months to weeks)

- Deep Fake Stunts: AI creates stunt doubles, eliminating danger

- Script Analysis: AI predicts which scripts will succeed

- Casting: AI analyzes which actors best fit roles

- Post-Production: AI de-aging actors, color grading, editing

Real Examples (2025)

- Marvel Studios: Using AI to speed up VFX pipeline

- Netflix: AI analyzing viewing patterns to decide which shows to greenlight

- Industrial Light & Magic: AI de-aging technology for actors

The Controversy

Issues:

- Writers concerned about scripts generated by AI

- Actors worried about deepfakes replacing them

- Directors losing creative control to algorithms

- Copyright questions about training data

The Future

- 2026-2027: AI-generated content becoming more common

- 2028-2030: Hybrid human-AI creative process standard

- Beyond: Fully AI-generated films possible (though still inferior to human creativity)

AI in Music

Current Applications

- Composition: AI generating background music, jingles, royalty-free tracks

- Production: AI mastering, mixing, beat generation

- Recommendation: Spotify using AI to understand taste

- Voice Generation: AI creating vocal covers (Drake with AI voice)

Real Impact

Positive:

- More music created (democratizing production)

- Better production quality (AI mastering)

- Personalized playlists

Negative:

- Massive copyright issues (training on artists' work without permission)

- Musicians worried about job security

- Royalty disputes (who gets paid when AI music plays?)

- Loss of authenticity

The Question

Is AI-generated music actually music? Philosophical debate ongoing.

AI in Gaming

Current Applications

- NPC AI: More intelligent game characters (learning from player behavior)

- Content Generation: AI creating game levels, quests, stories

- Real-time Graphics: AI upscaling graphics in real-time (DLSS technology)

- Procedural Generation: AI generating vast game worlds

- Player Personalization: AI adapting difficulty to player skill

Real Examples

- Nvidia DLSS: AI upscaling graphics 2-4x faster without quality loss

- No Man's Sky: AI-generated planets and ecosystems (entire universe)

- Left 4 Dead: AI Director adapting game difficulty in real-time

- Minecraft with AI: AI generating infinite worlds

The Future

- Infinite procedurally-generated game worlds

- Game NPCs with genuine personality and learning

- AI opponents that learn from player behavior

- Games that adapt narrative based on player choices

- Photorealistic graphics powered by AI

The Creator Economy Impact

For Individual Creators

Positive:

- AI tools make creation easier (more creators possible)

- Lower barriers to entry

- Can compete with bigger budgets

Negative:

- More competition (everyone can create now)

- Commodification of creative work

- Harder to differentiate

- AI companies profiting from their work

For Entertainment Corporations

Opportunity: Reduce costs, create more content faster

Risk: Lose authenticity, alienate audiences tired of AI-generated content

The Authenticity Question

Key Tension: Can AI-generated entertainment be truly great?

- For: AI can combine best elements from millions of examples

- Against: True art requires human emotion, experience, struggle

Current Reality: AI-generated content is fine, but rarely exceptional

Future: Might improve, but might always lack that special human element

Conclusion: AI Will Transform, Not Replace

AI will dramatically change entertainment. It will become a tool creators use (like cameras in film). But the magic of entertainment—connecting with human emotion—still requires humans. AI will handle production, but humans will handle artistry. For now.

Explore more on AI in entertainment at TrendFlash.

Share this post

Categories

Recent Posts

Opening the Black Box: AI's New Mandate in Science

AI as Lead Scientist: The Hunt for Breakthroughs in 2026

Measuring the AI Economy: Dashboards Replace Guesswork in 2026

Your New Teammate: How Agentic AI is Redefining Every Job in 2026

Related Posts

Continue reading more about AI and machine learning

AI in Finance: How Agents & Generative Tools Are Transforming Risk, Trading & Compliance

The financial sector is being reshaped by autonomous AI agents and generative tools. Discover how these technologies are creating a competitive edge through sophisticated risk modeling, automated compliance, and adaptive trading strategies.

AI in Finance 2025: From Risk Models to Autonomous Trading

Discover how artificial intelligence is transforming financial services in 2025, moving beyond traditional models to power autonomous systems that optimize trading, enhance security, and navigate complex regulatory demands.

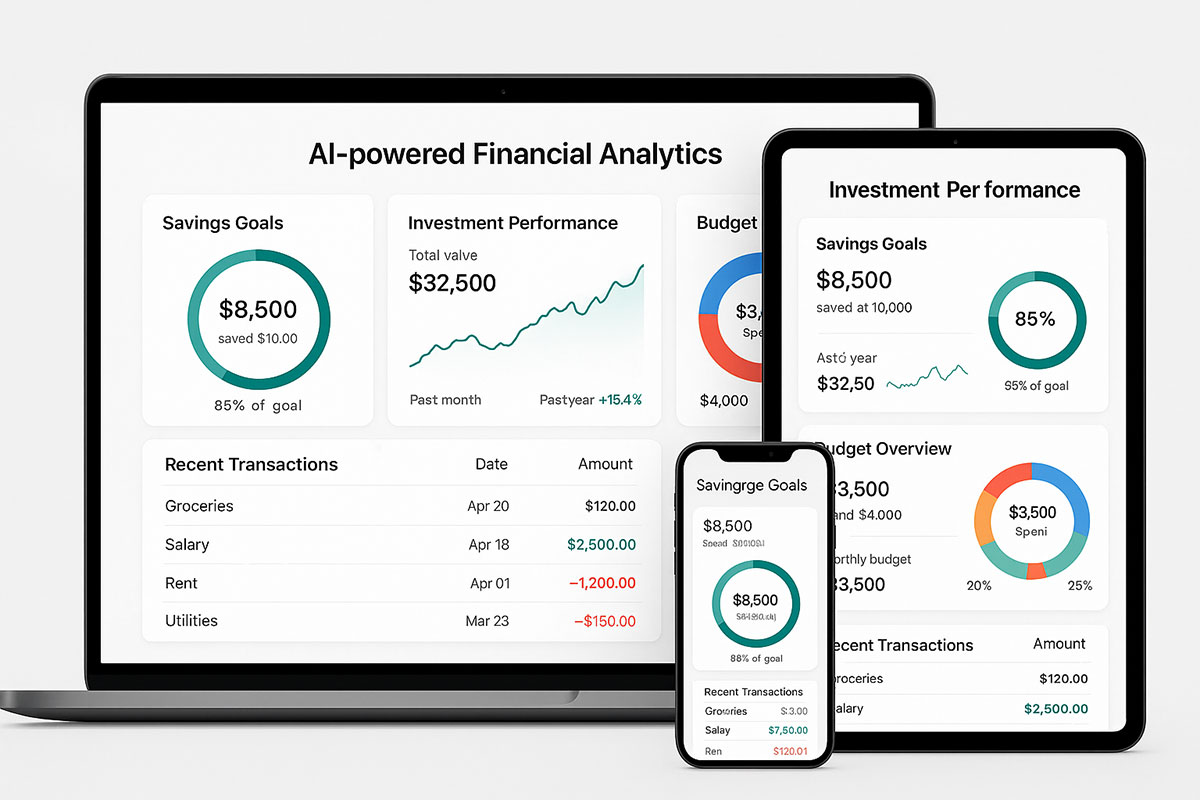

AI-Powered Personal Finance: How Algorithms are Managing Money in 2025

AI financial assistants now manage billions in personal assets. These smart systems optimize spending, automate investing, and prevent financial mistakes in real-time.