AI Fintech Startups in the US: How 2025 Is Reshaping Money Management

AI fintech startups in the US are redefining money management in 2025. From robo-investing to AI fraud detection, the finance revolution is underway.

TrendFlash

Introduction: The New Skill Everyone Needs

Prompt engineering is the art of asking AI the right questions. The difference between average AI output and exceptional output is often the quality of the prompt. This guide teaches prompt engineering fundamentals.

What Is Prompt Engineering?

Definition

The practice of crafting inputs (prompts) to AI systems to get desired outputs

Why It Matters

Same AI model with different prompts gives vastly different results

- Bad prompt: "Write an email" (mediocre generic email)

- Good prompt: "Write a professional email to a customer who's upset about late delivery. Apologize, offer 20% discount, ensure they feel valued" (much better)

The difference: 10 seconds of better prompting = 10x better output

Core Prompt Engineering Principles

Principle 1: Be Specific

Bad: "Write about AI"

Good: "Write a 500-word blog post about how AI is changing hiring practices. Target audience: job seekers. Tone: helpful and optimistic. Include 3 concrete examples."

Key: Specificity dramatically improves output quality

Principle 2: Provide Context

Bad: "Summarize this" (no context)

Good: "Summarize this article for a non-technical executive. Focus on business impact and actionable recommendations. Keep to 3-4 sentences."

Why: Context helps AI understand what you actually need

Principle 3: Give Examples

Bad: "Write in a professional tone"

Good: "Write in a professional tone. Here's an example: [example]. Follow this style."

Power: Examples dramatically improve consistency

Principle 4: Break Into Steps

Bad: "Analyze this problem and recommend a solution"

Good: "Follow these steps: 1) Identify the core problem, 2) List 3 root causes, 3) For each cause, suggest 2 solutions, 4) Recommend the best solution and explain why"

Impact: Step-by-step guidance produces better reasoning

Principle 5: Specify Output Format

Bad: "List marketing ideas"

Good: "List 5 marketing ideas. For each, format as: [Idea name] - [brief description] - [expected ROI]"

Benefit: Format specification ensures usable output

Advanced Techniques

Technique 1: Role-Playing

Format: "You are an expert [role]. Do [task]"

Example: "You are an experienced software architect. Review this code design and identify potential issues."

Result: AI adopts expert perspective, better quality

Technique 2: Chain of Thought

Format: "Let's think through this step-by-step"

Example: "Let's think through this business decision step-by-step: First, define success. Then, list constraints. Then, brainstorm options. Finally, recommend best option."

Result: Better reasoning, more thorough analysis

Technique 3: Constraining Scope

Format: "Assume only [constraints]. Then [task]"

Example: "Assume budget is limited to $5,000 and timeline is 1 month. How would you approach this project?"

Result: More practical, realistic recommendations

Technique 4: Iterative Refinement

Format: Use feedback to improve

Example:

- Initial prompt gets response

- You ask: "Can you make this more concise?"

- You ask: "Add more examples"

- You ask: "Rewrite for audience X"

Result: Converge to excellent output through iteration

Common Mistakes to Avoid

Mistake 1: Vague Instructions

Problem: "Write something interesting"

Fix: Be specific about what "interesting" means

Mistake 2: No Context

Problem: Assuming AI knows your situation

Fix: Provide necessary background

Mistake 3: Asking for Impossible

Problem: "Predict the future"

Fix: Ask what's actually possible

Mistake 4: Unclear Output Format

Problem: Hoping AI guesses what format you want

Fix: Specify exact format needed

Mistake 5: Trusting Without Verification

Problem: Assuming AI output is correct

Fix: Always verify, especially for facts

Practical Examples

Example 1: Content Writing

Bad Prompt: "Write a blog post about productivity"

Good Prompt: "Write a 800-word blog post about productivity hacks for remote workers. Target audience: busy professionals juggling multiple projects. Tone: practical and motivating. Include 5 specific, actionable tactics. Start with a hook that resonates with the target audience. Include at least 2 real-world examples."

Example 2: Code Review

Bad Prompt: "Review this code"

Good Prompt: "Review this Python function for: 1) Security vulnerabilities, 2) Performance optimization opportunities, 3) Code clarity and readability. For each issue found, explain why it's a problem and suggest a fix."

Example 3: Business Analysis

Bad Prompt: "Should we hire more people?"

Good Prompt: "Our company has 50 employees, $10M revenue, 30% YoY growth. We're considering hiring 10 more people (headcount +20%). Analyze: 1) Will productivity increase or decrease?, 2) What are the onboarding costs?, 3) What's the ROI timeline?, 4) What are risks?, 5) What's your recommendation and why?"

Mastering Prompt Engineering

Practice Tips

- Start with clear, specific prompts

- Document what works

- Experiment with different approaches

- Share prompts with others

- Refine continuously

Resources

- Prompt libraries (PromptBase, etc.)

- ChatGPT documentation

- Community examples

Conclusion: Prompt Engineering Is a Superpower

The ability to craft effective prompts will be a valuable skill in 2025+. Those who master it will get exponentially better AI output. Start practicing now.

Explore more on AI tools at TrendFlash.

Share this post

Categories

Recent Posts

Opening the Black Box: AI's New Mandate in Science

AI as Lead Scientist: The Hunt for Breakthroughs in 2026

Measuring the AI Economy: Dashboards Replace Guesswork in 2026

Your New Teammate: How Agentic AI is Redefining Every Job in 2026

Related Posts

Continue reading more about AI and machine learning

AI in Finance: How Agents & Generative Tools Are Transforming Risk, Trading & Compliance

The financial sector is being reshaped by autonomous AI agents and generative tools. Discover how these technologies are creating a competitive edge through sophisticated risk modeling, automated compliance, and adaptive trading strategies.

AI in Finance 2025: From Risk Models to Autonomous Trading

Discover how artificial intelligence is transforming financial services in 2025, moving beyond traditional models to power autonomous systems that optimize trading, enhance security, and navigate complex regulatory demands.

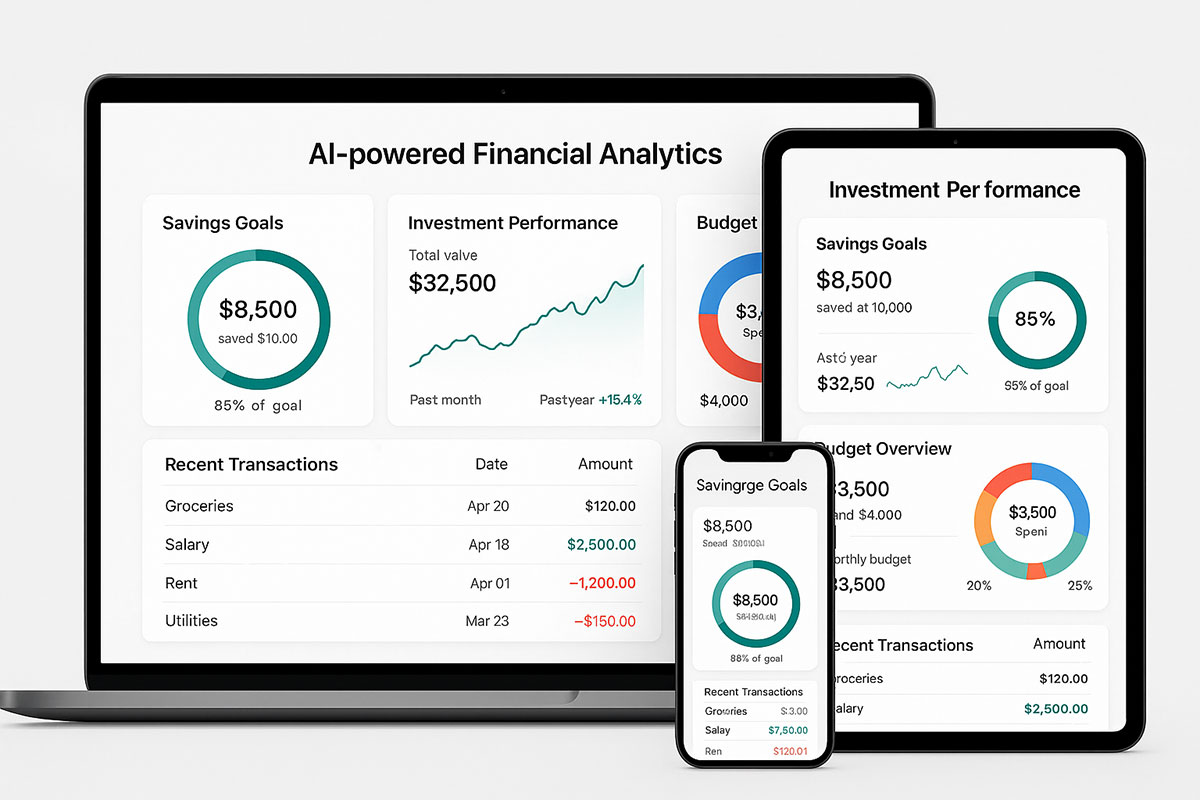

AI-Powered Personal Finance: How Algorithms are Managing Money in 2025

AI financial assistants now manage billions in personal assets. These smart systems optimize spending, automate investing, and prevent financial mistakes in real-time.