AI Credit Scoring in 2025: How Algorithms Are Redefining Lending in the US

In 2025, AI-driven credit scoring is transforming lending in the US. Banks and fintech's now rely on smarter algorithms to decide who gets access to loans.

TrendFlash

Introduction: The Legal Minefield

If you use AI to create content, who owns it? You? The AI company? The original artists whose work trained the AI? The answer is still being litigated. This guide explores the copyright battleground.

The Core Problem

What Happened

- AI trained on billions of images, texts without permission or payment

- Artists' work used to train systems that compete with them

- No compensation to original creators

- AI companies profiting from artists' intellectual property

The Lawsuits

- Artists vs. Stability AI/Midjourney (2023): Class action lawsuit

- Authors vs. OpenAI: Claims ChatGPT trained on books without permission

- Getty Images vs. Stability AI: Copyright infringement claim

- More coming: Dozens of cases pending

The Legal Questions

Question 1: Can You Legally Train AI on Copyrighted Work?

Current law: "Fair use" might allow it for training (transformative purpose)

AI companies' defense: Training is transformative, falls under fair use

Artists' argument: Fair use shouldn't allow commercial exploitation without compensation

Status: Courts still deciding (ongoing litigation)

Question 2: Who Owns AI-Generated Content?

If you create with AI: Do YOU own the output?

Current positions:

- US Copyright Office: AI-generated content might not be copyrightable (needs human authorship)

- Some countries: Treating AI as tool, creator owns output

- Uncertain: If AI generated it with minimal human input, who owns?

Question 3: Can You Use AI Output Commercially?

If you generate image with Midjourney: Can you sell it?

Current status:

- Midjourney terms: Yes, for paid users

- DALL-E: Yes, OpenAI claims ownership not retained

- Stability AI: Yes, under certain conditions

- BUT: If image too similar to training data, might infringe on original artist's copyright

Question 4: Who's Liable if AI Output Infringes?

Scenario: You generate image with AI, turns out it's 99% copy of real photo

Who's liable?

- You (creator of the output)?

- AI company (built the system)?

- Both?

Status: Unclear, likely both

The Current State (November 2025)

What's Settled

- AI training on copyrighted work IS happening (legally grey but happening)

- Lawsuits are ongoing

- Compensation to original creators is NOT happening yet

What's Unsettled

- Fair use boundaries for AI training

- AI output copyrightability

- Liability for infringing AI outputs

- International coordination (US vs. EU vs. others)

Likely Outcomes (2026-2030)

Scenario A: Artists Win (Some Protections)

- AI training requires opt-in or payment

- Copyright protections strengthened

- Compensation fund created for original artists

- Probability: 30%

Scenario B: Tech Companies Win (Status Quo)

- Fair use expanded for AI training

- Minimal restrictions on AI training

- Artists get no compensation

- Probability: 20%

Scenario C: Compromise (Middle Ground)

- Some restrictions on training

- Opt-out mechanisms for artists

- Limited compensation

- Regulatory framework established

- Probability: 50%

For Creators Using AI

Safe Uses

- Generate original content for your own use

- Create derivative works (clearly transformative)

- Use within terms of service

Risky Uses

- Generate content that's too similar to training data

- Use outside terms of service

- Claim ownership of generated content as unique art

Best Practices

- Read terms of service for AI tool

- Understand what you're allowed to do

- Disclose AI usage (transparency)

- Don't claim credit for AI-generated work

- Be aware of copyright status

For Original Artists

Protect Your Work

- Add opt-out requests to copyrighted work (where available)

- Use "no AI training" licenses

- Document your original work (timestamp, etc.)

- Monitor for similar AI-generated outputs

Consider Legal Action

- Join class action lawsuits

- Report infringement

- Document damage

Conclusion: The Battle Rages On

The copyright wars are just beginning. The stakes are enormous (trillions in value). Expect years of litigation before clarity. The question isn't whether lawsuits will happen—it's what the courts will decide.

Explore more on AI ethics at TrendFlash.

Share this post

Categories

Recent Posts

Opening the Black Box: AI's New Mandate in Science

AI as Lead Scientist: The Hunt for Breakthroughs in 2026

Measuring the AI Economy: Dashboards Replace Guesswork in 2026

Your New Teammate: How Agentic AI is Redefining Every Job in 2026

Related Posts

Continue reading more about AI and machine learning

AI in Finance: How Agents & Generative Tools Are Transforming Risk, Trading & Compliance

The financial sector is being reshaped by autonomous AI agents and generative tools. Discover how these technologies are creating a competitive edge through sophisticated risk modeling, automated compliance, and adaptive trading strategies.

AI in Finance 2025: From Risk Models to Autonomous Trading

Discover how artificial intelligence is transforming financial services in 2025, moving beyond traditional models to power autonomous systems that optimize trading, enhance security, and navigate complex regulatory demands.

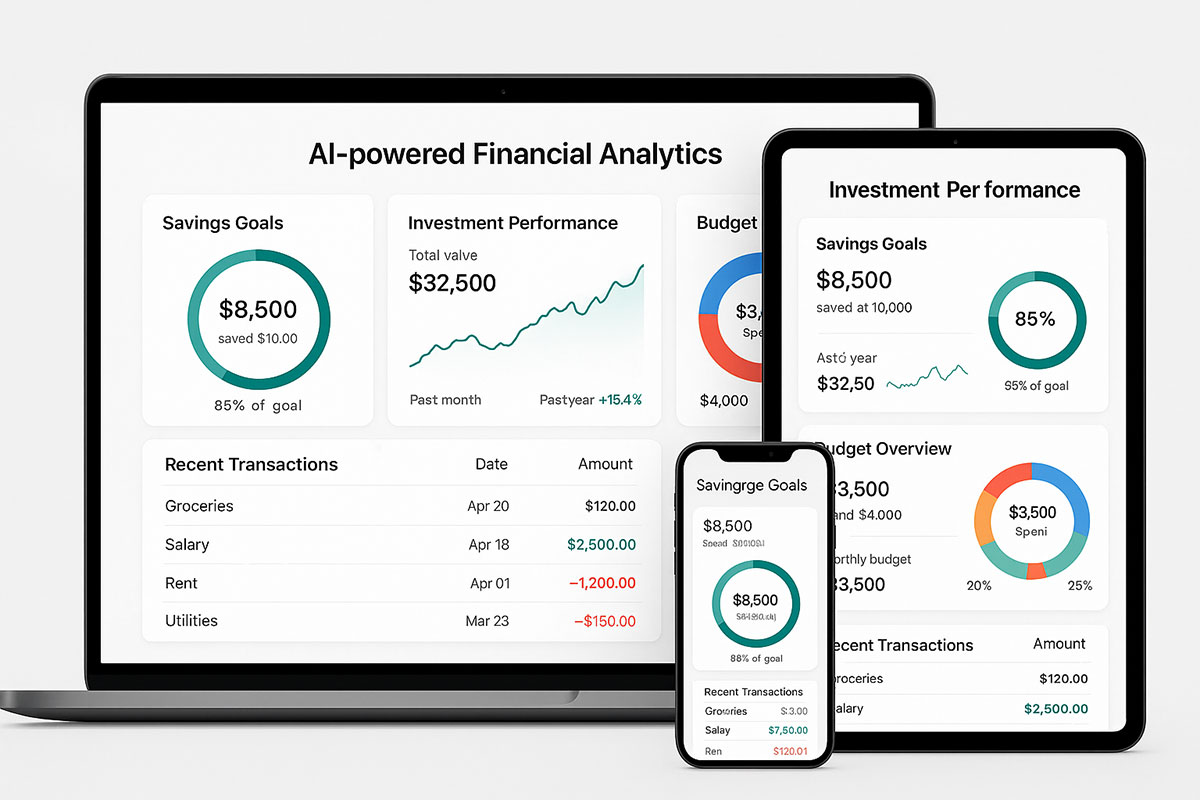

AI-Powered Personal Finance: How Algorithms are Managing Money in 2025

AI financial assistants now manage billions in personal assets. These smart systems optimize spending, automate investing, and prevent financial mistakes in real-time.