Can AI Predict Cryptocurrency Markets in 2025?

Cryptocurrencies are volatile, but AI promises smarter predictions. In 2025, traders are using AI to analyze patterns and forecast crypto market movements.

TrendFlash

Introduction: The Crypto Prediction Question

Cryptocurrency volatility is legendary. Bitcoin can swing 20% in a day. In 2025, AI systems are being deployed to predict crypto prices with increasing sophistication. But can they really predict crypto markets? And should you trust them?

This guide examines what AI can and cannot do for cryptocurrency prediction, real-world accuracy, and what it means for crypto traders.

Why Crypto Is Different (And Harder to Predict)

Stock Markets vs. Crypto Markets

Stock Markets:

- Decades of historical data

- Fundamental analysis possible (earnings, revenue, assets)

- Regulatory framework (reduces uncertainty)

- Institutional stability

- Relatively efficient pricing

Crypto Markets:

- Only 15-20 years of data (very limited)

- Fundamental analysis mostly impossible (crypto assets don't produce cash flow)

- Minimal regulation (creates uncertainty)

- Extreme volatility (400% annual swings common)

- Heavy speculation and sentiment-driven

- 24/7 trading (different dynamics than stock markets)

Bottom line: Crypto is fundamentally harder to predict than stocks.

What AI Can Predict in Crypto

1. Short-Term Momentum (24-48 hours)

AI can predict short-term price movements with 55-65% accuracy:

- Technical patterns (support/resistance levels)

- Volume spikes

- Sentiment shifts

- Market microstructure

Accuracy Range: 55-62% (marginally better than 50% random)

2. Extreme Volatility Events (Crashes/Pumps)

AI can identify unusual behavior patterns predicting crashes:

- Volume anomalies

- Order book imbalances

- Cascading liquidations signals

- Social media sentiment spikes

Accuracy: 70%+ for detecting extreme movements within hours

3. Correlation Patterns

AI identifies how different crypto assets move together:

- Bitcoin dominance cycles

- Altcoin rotation patterns

- Macro correlation shifts

Accuracy: Good (60-75%) for identifying rotation patterns

4. Sentiment Analysis

AI reads social media, news, whale movements:

- Twitter sentiment

- Reddit discussions

- News sentiment

- Blockchain transaction analysis (whale tracking)

Accuracy: Moderate (55-65%) but actionable for timing

What AI CANNOT Predict in Crypto

1. Black Swan Events

Unpredictable external shocks:

- Regulatory bans (China crypto ban 2021)

- Exchange hacks/collapses (FTX)

- Macro economic shock (sudden inflation spike)

- Security vulnerabilities discovered

AI Limitation: By definition unpredictable (never happened before)

2. Long-Term Price Direction (6+ months)

Crypto lacks fundamental anchors for long-term prediction:

- No earnings to forecast

- No intrinsic value to calculate

- Purely sentiment/adoption-driven

- Regulatory landscape constantly changing

Prediction Accuracy: Worse than random for 6-12 month horizons

3. New Cycle Patterns

Each crypto cycle is different:

- Different drivers (2017: ICO mania, 2021: retail FOMO, 2025: AI narratives)

- Different participants

- Different macro environment

Problem: Historical patterns don't repeat exactly

4. Adoption Curves

When will crypto actually be adopted? Unknown:

- Could explode (adoption S-curve)

- Could stagnate (limited use cases)

- Could be replaced (better technology)

AI Limitation: No data yet on whether adoption happens

Real AI Crypto Prediction Models

Model 1: Time Series Forecasting

Method: LSTM neural networks trained on historical price data

Accuracy: 55-60% for next-day predictions

Problem: Works until it doesn't (regime changes destroy accuracy)

Model 2: Sentiment Analysis

Method: NLP analyzing social media, news, on-chain data

Accuracy: 60-65% for short-term sentiment-driven moves

Advantage: Works specifically during high-sentiment periods

Model 3: Ensemble Methods

Method: Combining multiple models (technical, fundamental, sentiment)

Accuracy: 62-68% for 24-48 hour predictions

Best Practice: Most successful traders use ensemble approaches

Real Performance Data

Documented AI Trading Results (2024-2025)

- Short-term algorithmic traders: 12-25% annual returns (after fees)

- ML-based crypto hedge funds: 15-30% annual returns

- Sentiment-based strategies: 8-18% annual returns

- Buy-and-hold Bitcoin: -5% to +150% (highly variable)

Key Insight: AI trading beats buy-and-hold but has draw-downs. Past performance doesn't guarantee future results.

Why AI Predictions Fail in Crypto

Reason 1: Regime Changes

Market dynamics shift. Models trained on bull market fail in bear market.

Reason 2: Low Signal-to-Noise Ratio

Crypto is ~90% noise, 10% signal. Models overfit to noise.

Reason 3: Reflexivity

Price predictions influence price. If everyone buys based on same prediction, it self-fulfills (then breaks).

Reason 4: Data Limitations

Only 15 years of data. Insufficient for training robust models.

Should You Use AI Crypto Predictions?

For Day Trading

Answer: Maybe helpful

- AI can improve odds marginally (55-65% accuracy)

- Requires active management and risk controls

- Most day traders lose money anyway (AI or not)

For Swing Trading (Days to Weeks)

Answer: Possibly useful

- Sentiment analysis can identify turning points

- Technical pattern recognition helpful

- Still risky and requires discipline

For Long-Term Investing

Answer: Not useful

- AI cannot predict long-term direction

- Better to use fundamental theses

- Dollar-cost averaging more reliable

For Risk Management

Answer: Very useful

- AI can detect unusual volatility patterns

- Useful for position sizing and stops

- Helps prevent catastrophic losses

The Bottom Line

AI can modestly improve crypto trading at short time horizons (24-48 hours), but:

- Cannot predict long-term direction

- Cannot predict black swan events

- Performance is marginal (55-65% accuracy)

- Requires active management

- Most profitable use is risk management

Conclusion: If you're trading crypto anyway, AI tools can help. But AI won't turn you into a consistent winner. The market is still mostly unpredictable.

Explore more on AI in finance and crypto AI at TrendFlash.

Share this post

Categories

Recent Posts

Opening the Black Box: AI's New Mandate in Science

AI as Lead Scientist: The Hunt for Breakthroughs in 2026

Measuring the AI Economy: Dashboards Replace Guesswork in 2026

Your New Teammate: How Agentic AI is Redefining Every Job in 2026

Related Posts

Continue reading more about AI and machine learning

AI in Finance: How Agents & Generative Tools Are Transforming Risk, Trading & Compliance

The financial sector is being reshaped by autonomous AI agents and generative tools. Discover how these technologies are creating a competitive edge through sophisticated risk modeling, automated compliance, and adaptive trading strategies.

AI in Finance 2025: From Risk Models to Autonomous Trading

Discover how artificial intelligence is transforming financial services in 2025, moving beyond traditional models to power autonomous systems that optimize trading, enhance security, and navigate complex regulatory demands.

AI-Powered Personal Finance: How Algorithms are Managing Money in 2025

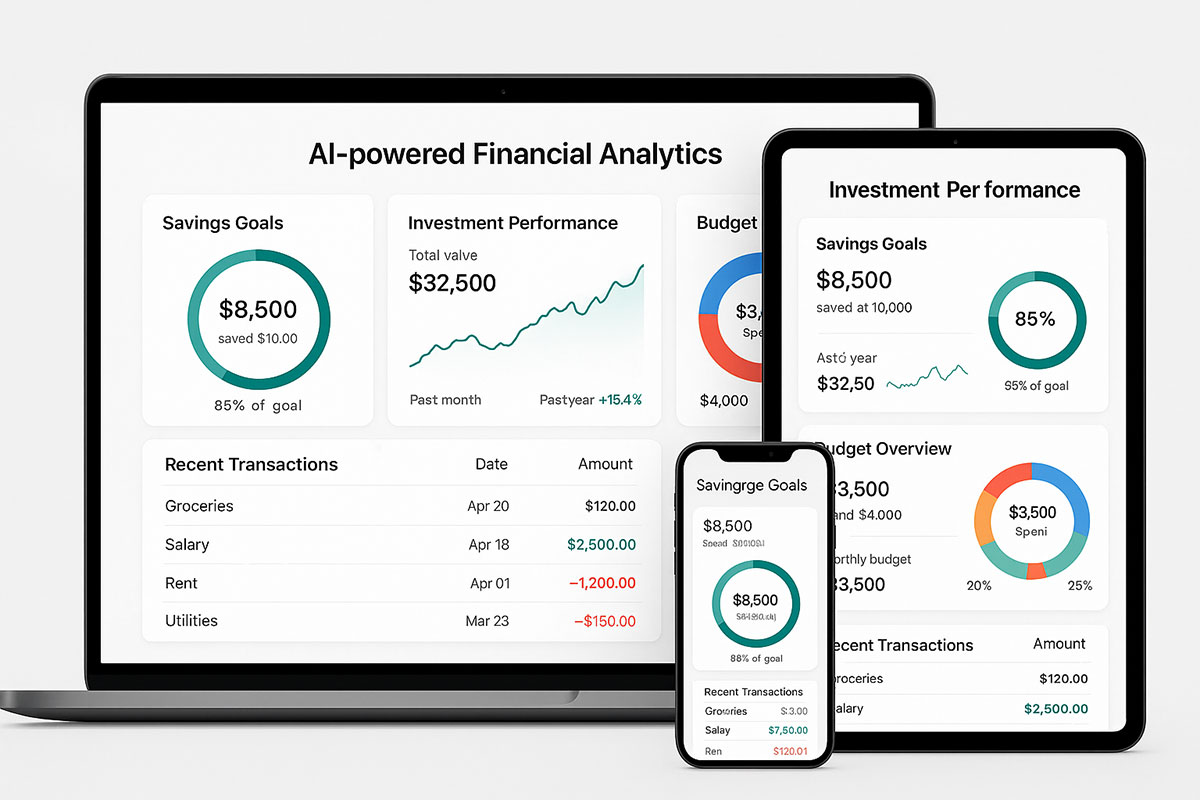

AI financial assistants now manage billions in personal assets. These smart systems optimize spending, automate investing, and prevent financial mistakes in real-time.